Silver train is a comin',

think I'm gonna get on now, oh, yeah.

Silver train is a comin',

think I wanna get on now, oh, yeah, oh, yeah.

Silver rain is a fallin',

fallin' up around my house, oh, yeah,

silver rain is a fallin', fallin' up around my house, oh, yeah, oh, yeah.

And I did not know her name, and I did not know here name,

but I sure love the way that she laughed and took my money.

And I did not know here name, and I did not know her name,

but I sure loved the way that she laughed and called me Honey.

Any chance Orko Silver Corp was around in '73?

Mick's right about wanting to get on though! Never mind about the money taking part, that is just for the ticket, at the end of the ride you will be well reimbursed.

Orko Silver Daily Chart

Chart is courtesy of marketclub.

Marketclub - Orko Silver Corp. Trend Analysis.

Am I allowed to be excited? What a day! Now I had decided for myself to wait for a breakout before doing another chart on Orko Silver. Not much sense doing a chart if certain conditions have not been met,...right?

Am I allowed to be excited? What a day! Now I had decided for myself to wait for a breakout before doing another chart on Orko Silver. Not much sense doing a chart if certain conditions have not been met,...right?But today, they were met and more then so!

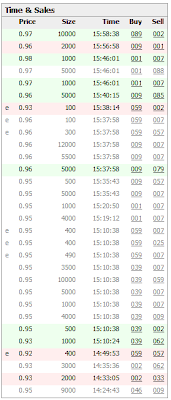

However, lets rewind to that very moment when everybody was still busy cleaning the puss out of their eyes. Orko Silver Corp was already looking at a lower opening of 0.86. What a bummer I thought. Another hour passed and we were already looking at 0.85 on the boards. Couldn't get any better.

But then, suddenly around 10:10 am I noticed gold steadily increasing and after just a few moments we were already trading around 1079 ;-)

The action was too strong, something had to have happened. Turned out later that India was buying IMF gold

Well, as of that moment all bets were off.

As of 11:00 am Orko Silver was on a rise and destined to break 1.00. The rise today was on pretty decent volume and with some good bids around 0.95.

Looking at the chart, all indicators are bullish. I could not find one thing to award a red minus on the chart, not a single thing! Only green green green, I also checked the weekly chart of course. We have an MACD which could do a bullish crossover anytime, stochastics and RSI are again showing significant upside potential and we could move a bit higher now before reaching overbought again.

There is still the possibility of the market reacting to the cup and handle depending on what volume we get when breaking the 1.04. If momentum is good, expect everyone to jump on board, it is a self-fulfilling prophecy and thus a bullish scenario.

We are in November now, so that means that either this or next week we could be expecting the long awaited news release in our mailbox. That could provide us with enough sparks to validate and enforce the Cup and Handle. This is me hoping, hope you understand that...as I always say, always reach for the stars and touch the sky.

Orko Silver surged over 12% today and closed at 0.97 +0.100 (11.49%)

Oh, about the chart, you'll see that I have already taken a new Fibonacci low to draw my retracements, that means I'm now looking at the 0.81 as our new low. Going back and using the August low as start point of my Fibonacci Retracement invalidates last Octobers rally....and that would not be correct. In October we rallied to 1.04 and now we are retracing from that rally. That is how you have to see it.

Fibonacci wise the stock price shows some strong action, breaking all Fibonacci levels and thus from that I would be looking at Orko Silver making a break for the 100% Fibonacci level and thus a break of 1.04, either tomorrow or the next days. Depending upon the actions of gold and silver of course.

choo choo!!

choo choo!!YeOldGoldNugget's links of interest

- Has the S&P broken final support?

- One Indicator The Government Can’t Ignore

- Seven market lessons guaranteed to improve your trading

- 5 Markets & 5 Ways To Improve Your Trading Profits In the coming years ahead

- 90 Second Gold Lesson (Video)

- 100% Returns on a Canadian Stock (Video)

- Introducing the Perfect Portfolio

- What does winter hold for Crude Oil?

- All 7 Traders Whiteboard videos

- Free Email Trading Course Copy

- New Video: ETF GLD is analyzed

- Register for all the latest Trader's Blog postings Today.

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)

.png)