TSX VENTURE: OK

Orko Silver Corp.

Nov 12, 2009 09:00 ET

Orko Silver Continues to Receive Encouraging Drilling Results

The original news release on the Orko Silver Corp. website can be found by clicking here.

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 12, 2009) - Orko Silver Corp. (TSX VENTURE:OK) is pleased to announce that it continues to receive favorable results from the ongoing drilling program being completed by our joint venture partner, Pan American Silver Corp. (PAA) on the La Preciosa Project in Durango, Mexico.

Diamond drill hole BP09-375 yielded 15.65 metres grading Au 0.579 g/t and Ag 439.4 g/t for a silver-equivalent of 474.1 g/t. Included in this hole is an interval of 5.85 metres grading Au 1.146 g/t and Ag 942.0 g/t for a silver-equivalent of 1,010.7 g/t. Also of note is hole BP09-392 with 16.89 metres grading Au 0.441 g/t and Ag 225.3 g/t for a silver-equivalent of 251.8 g/t.

Gary Cope, President of Orko Silver, states:

We are extremely pleased to see that Pan American's delineation drilling results confirm those initially reported by Orko Silver. The presence of wide high grade intervals is also very encouraging for the project.

The Pan American Phase-I delineation (infill) drilling at La Preciosa consisted of 19 HQ diamond drill holes for a total of 6,316.83 meters and was reported in a news release dated September 08, 2009.The Phase-II drilling program has commenced and includes further delineation drilling, plus drilling on the previously identified exploration targets located immediately surrounding the La Preciosa deposit. To date, PAA has drilled 40 Phase-II holes, an additional 17 delineation holes and 23 holes on the exploration targets for a total of 9,924.44 meters. Assays for 25 of the Phase-II holes are now available. Delineation drilling is in the Central Area of the La Preciosa Resource. Exploration drilling around the periphery of the Resource includes nine holes from the South Area on the Martha Vein.

Multiple mineralized intercepts are presented in the two tables for the Central Area and South Area testing of the Martha Vein.

The delineation results from the new holes are all located in the known Martha vein structure and were drilled at approximately 50 metre spacing in an area previously drilled by Orko Silver at 100 metre spacing. This data again confirms Orko Silver's previously reported results, and will form the basis of a geostatistical study, toward ultimate resource definition. Phase-II diamond drilling is still underway.

The results of the exploration drilling to date from Baritina and El Vaquero, which are targets outside of the Martha vein resource, have been inconclusive. Further drilling has been done in both areas; results of which are pending. Based on the visual information encountered in the drill core and geological interpretation on cross sections, additional drilling is contemplated in these areas during November and December.

Central Area – La Preciosa Resource

*- In certain holes the Martha vein can be composed of several sub-parallel, silver rich veins: Martha (Sup) - refers to that portion of the Martha vein above the main Martha vein (Superior), and Martha (Inf) - refers to that portion of the Martha vein below the main Martha vein (Inferior)

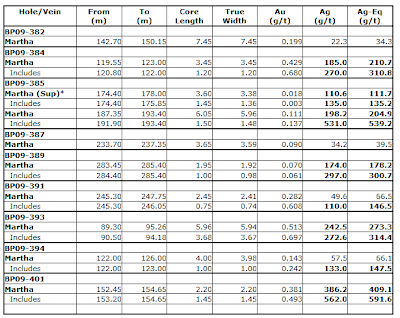

South Area – La Preciosa Resource

*- In certain holes the Martha vein can be composed of several sub-parallel, silver rich veins: Martha (Sup) - refers to that portion of the Martha vein above the main Martha vein (Superior), and Martha (Inf) - refers to that portion of the Martha vein below the main Martha vein (Inferior)

A complete table of drill results is available on our website at the link below:

http://www.orkosilver.com/i/pdf/drillresults.pdf

A detailed drill plan map is available on our website at the link below:

http://www.orkosilver.com/i/pdf/drillplanmaps.pdf

A printer friendly PDF format of this news release is available at the link below:

http://www.orkosilver.com/i/pdf/orkonews11122009.pdf

Ben Whiting, P.Geo., and George Cavey, P.Geo are the Qualified Persons for Orko Silver Corp. and take responsibility for the technical disclosure in this news release.

Silver-equivalent for the purposes of this drilling program is defined as silver grade plus 60 times gold grade. Metallurgical recoveries and net smelter returns are assumed to be 100% for the silver-equivalent value. Base metal values are not included in the silver-equivalent.

About Orko Silver Corp.

Orko Silver Corp. is developing one of the world's largest primary silver deposits, La Preciosa, located near the city of Durango, in the State of Durango, Mexico.

ON BEHALF OF THE BOARD OF DIRECTORS

Gary Cope

President

This News Release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Orko relies upon litigation protection for forward-looking statements.

The TSX Venture Exchange has not reviewed and does not accept responsibility for this News Release.

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)

.png)