A lump of pure gold is so simple,why pay one penny more than you should?

A lump of pure gold is so simple,why pay one penny more than you should? YOU MIGHT THINK it easy enough.

Buy gold. Hold it securely, and then sell it — at a time of your choosing — for full value.

Gold itself, after all, couldn't be simpler. Sitting at No.79 in the Periodic Table, it's a mere lump of metal, prized for its beauty and rarity, and used to store wealth for more than 5,000 years.

Yet buying and selling gold is rarely made easy for private investors. And it's almost never made cheap.

- Coins & bars you can hold in your hand — but only if you're willing to pay very high dealing, handling & shipping costs, plus high insurance or safety-deposit bills;

- Certificates and "pool" programs often charge more in annual storage fees than most mutual funds charge for active stock selection;

- Futures & options greatly increase your risk of short-term losses, and their hidden costs soon add up;

- Exchange-traded funds (gold ETFs) claim to trade like a stock, but they rely on complex trust deeds to "track" the gold price — and they fail to give you any real physical ownership.

So many ways to buy gold! And so many ways to pay more than you need to get less than you want.

How the Professional Gold Market Works

Traders in the professional gold market don't put up with complex trust deeds, of course. Nor do they suffer wide spreads, fat commissions or high storage fees.

This exclusive club only deals in what are known as "Good Delivery" gold bars. Warranted to be 99.5% pure gold, and cast by market-approved refiners, these 400-ounce bars of solid gold bullion are all that professional gold dealers want.

Weight and purity both come without question, so the "spread" between prices to buy and prices to sell is cut to a fraction of what you'll pay a gold-coin dealer.

These big wholesale gold bars, in short, offer you big wholesale savings.

If you're not trading Good Delivery gold bars, you're also locked out of the ultra-secure vaults where professional traders keep their gold. Deep below ground, these market-approved facilities are the safest places on earth for privately-owned gold.

That's why annual storage fees — with insurance included — run to 0.12% or less.

But trying to put just one big bar of gold into secure storage won't be enough, however. Professional vault operators demand a minimum holding of 15 large bars or more — and that would now cost you $6.03 million at today's prices.

A Break-Through for Private Investors

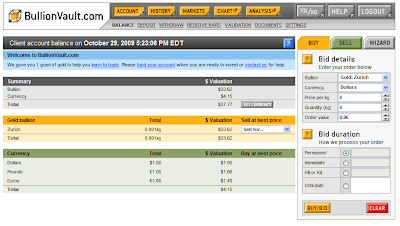

How can you get in? BullionVault now makes these big bars of professional gold available to private investors around the world.

As ever, buying wholesale is much cheaper than paying retail. And you can start with as little as one gram of gold today — for free — by registering here...

Use the simple, straightforward order board at BullionVault today, and you can buy and sell Good Delivery gold instantly with no risk of default.

The spread between prices to buy and prices to sell regularly runs to just 0.3% and below. And the gold you buy at BullionVault belongs to you — and you alone — the very moment you deal.

How does it work? Because all BullionVault gold is already safe & secure inside professional gold storage, there's no shipping & no delivery costs.

Only ownership changes hands, and only ever in return for cleared cash funds. There's no credit and no leverage at BullionVault.

The Safest Way to Own Real Gold Bullion

Your total dealing costs will be up to 80% lower than buying gold coins. Storing your gold in our secure, market-approved vaults will then cost less than one-third the fees of using an exchange-traded gold fund (ETF).

You also get to choose where to store your gold, selecting from our secure, market-approved gold vaults in your choice of New York, London or Zurich, Switzerland.

Remember — all deals at BullionVault are settled with gold that's already safe, inside the vault. So you face no risk of default.

The very instant you buy, your gold belongs to you — outright, in your name alone. And as it's your property, your gold remains safe from the financial performance of BullionVault, too.

No one can use your gold to repay their debts. We simply look after it for you, saving you money and hassle, in return for a small annual fee of 0.12% per year (minimum $4 per month).

Start Today with This Free Gram in Zurich

BullionVault's quiet revolution in the global gold market is fast-gathering pace — and it's already been featured by the Financial Times, Stern magazine in Germany, CNBC, Bloomberg News, and many other highly-respected news sources.

You can join this service today at no cost to yourself. Simply register here for a free gram of gold, stored on your behalf in Zurich, Switzerland.

Register now, and you can then sell this gram...buy it back...and sell it again to test-drive the BullionVault service without risking one penny of your own money.

Opening a Risk-Free Trading Account will put you under no obligation to buy gold, and no salesman will call.

Nor will we spam, rent or abuse your email address in any way.

If you find that you like the safety, simplicity, and low prices that BullionVault offers, then simply follow the instructions online to fund your account and start investing in gold.

Because buying gold doesn't need to be hard — and it need not be expensive.

Trend Analysis

Get the most recent Trend Analysis on Gold Spot by following this link :

Marketclub - Gold Spot Trend Analysis

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)

.png)