A Monday Morning Musing from Mickey the Mercenary Geologist.

It was the last day of the January 2008 Cambridge House Investment Conference in Vancouver. There were hundreds of companies represented and the floor was packed with thousands people strolling casually down the aisles. I like to move fast at these shows and this one was not very conducive to my modus operandi.

I was tired after two long days working the exhibit hall floor and was becoming increasingly frustrated.

Though the junior resource market had begun its long journey south commencing with the Galore Creek debacle the previous November, I had not found a new undervalued stock at an investment conference for over four months. Every company I looked at during the previous three conferences either had something amiss based on my strict evaluation criteria of share structure, people, and projects (Mercenary Musing December 15, 2008) or had an unattractively high and largely undeserved market valuation.

Who could know that with the pending bankster meltdown, junior resource market capitalizations would plummet over the next 11 months? True to my nature, I was focused fully on the here and now.

At 4:30 pm I walked out of the speaker room to the exhibit hall, took a hard right and happened to glance over to the second booth in the row. A pure silver play in Mexico caught my eye. Thus I was first introduced to Oremex Resources Inc. (ORM.V) and their Tejamen silver project in Durango, Mexico. Un sapo, no?

There are many junior and a few mid-tier “silver companies” operating in the Americas; they are especially prevalent in the major silver producing countries of Mexico, Peru, and the USA. I’ll ignore Bolivia at this point because of its current cocalero version/vision of socialism and nationalization, the so-called “Evo-nomics”.

But few qualify as silver companies with actual silver plays. Most are really small and medium-sized lead-zinc companies with base metal mills and concentrators and smelter contracts that recover silver as a by-product. I do not like juniors with counter party risk and the worst kind of counter party risk is being an indentured servant to a major mining company- or sovereign government-owned smelter. These

polymetallic producers prosper when primary industrial metal products lead, zinc, and/or copper are in demand and prices are high. They struggle, suffer, become shells, or go bankrupt when world economies are less than robust and base metal prices are on the down and out.

Most analysts, writers and investors know that it’s just damn hard to find a pure silver play in the junior resource or mid-tier mining sectors.

I found one some 23 months ago:

Oremex Resources Inc. (ORM.V) has been parked on my radar screen since then and has not taken off or really even started up for nearly two years. It had a problem.

The problem was this: Three previous CEO’s and various management teams failed to secure a surface use agreement with the local ejido and village on their flagship silver property in central Mexico. In a nutshell, socio-economic relationships were not developed properly by management and the company reached an impasse with some locals over surface access. Oremex then went thru a period from late 2005 to early 2009 with a veritable merry-go-round of incoming and outgoing officers and directors who just did not get the job done.

Obtaining clear title to surface rights and support of the local community can be problematic for exploration, development, and mining companies in Mexico. Though Mexico is a favored jurisdiction for gold and silver mining, surface rights are a geopolitical issue that have delayed or derailed a few potential mining operations in the country over the past several years (e.g., Mina Cerro San Pedro in San Luis Potosi, Campamento in Chiapas).

Oremex was a 27-35 cent stock when I first examined the company and spoke extensively with the former CEO in late January 2008. Earlier that month it had announced start of a pre-feasibility study on its Mexican silver project. That never happened because of the aforementioned surface access and rights problem.

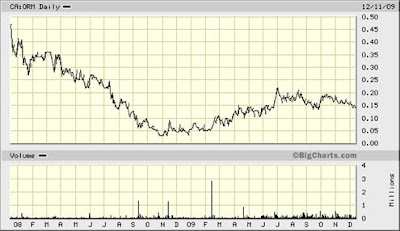

ORM traded in that range until macroeconomic factors began to take their toll on junior resource stocks in the early spring. As markets bottomed in late October to early November 2008, it could be had for 3.5-5 cents. The company did not fare much better despite an overall improving market in the first six weeks of 2009.

A look at the two year chart shows the story or lack thereof until mid-February 2009 when completely new leadership assumed control of the company. The stock price immediately started to rise. Since mid-June it has built a nice base in the mid-high teens despite no material news:

The company has 72.8 million shares outstanding and 91.7 million fully diluted. Insiders, family and friends control 20%, institutions 20%, and the public float is 60%. At the current price of 14c, it has a market capitalization of about $10 million. A recent small private placement raised $520,000 and another will be closed this week to add $450,000. There are 14.1 million warrants in the money at 15 cents with expiries of February and July 2011 and 3.7 million at 17 cents expiring in November and December 2011.

Management holds 3.5 million options at a strike price of 10c. Note that all shares and warrants include the two recent financings.

Liquidity over the past six months has been moderate, trading about 800,000 shares per week. The 52 week high and low is 24 cents and 3.5 cents respectively, and in the past 30 days the stock has ranged from 13.5 to 20 cents. The company will have $1.4 million in working capital at week’s end and burn rate is very low at $45,000 per month.

You will note that this is a large number of shares for most advanced exploration companies that I cover.

But I often say when giving my pitch to potential clients that “everyone has his warts” and “please realize that I will discuss both the positives and the negatives of your company in my analysis.”

Rest assured I will not try to gloss over anything or pull the wool over the eyes of anyone. In the case of ORM, the company has a large number of shares and many cheap warrants which could overhang the market and limit the share price.

However, the story is compelling enough that I am willing to discount this flaw.

The reasons I like Oremex Resources are three-fold: The people, the flagship project, and the current market capitalization.

• Firstly, the people. They include:

Chairman John Carlesso is a merchant banker and financier with Toronto-based Cervello Capital. He has executive experience with successful junior resource companies. I have spent several hours in meetings with John doing my due diligence of Oremex for the past three months.

CEO Michael R. Smith is a geologist with major mining and junior resource exploration, development, and mining experience in the Americas. His resume includes stints as Barrick’s Chief Mine Geologist at Goldstrike, Nevada and its General Manager of Development and Exploration in Peru and Bolivia.

Carlos Pacheco is a geologist with almost 20 years of experience in exploration, development and operations, with major Mexican mining and Canadian junior companies. He manages community relations and assists in business development.

Director Dave Prins is a civil engineer who was an integral part of Placer Dome’s project development teams at Porgera in Indonesia, Quebrada Blanca and Cerro Casale in Chile, and Pueblo Viejo in the Dominican Republic. Dave and I worked together on an advanced copper oxide project in Chile in 2006-2007 and I can vouch for his expertise in project development.

Geologist Ritch Hall is on the company’s advisory board. He brings valuable experience in mine development, permitting, and Mexican socio-economic issues as the former CEO of Metallica Resources.

As an aside, I have known Ritch since a sunny Sunday in the summer of 1986 when we met as competitors while sampling the same dozer cut on a prospect in northern Montana. He worked for a midtier Canadian mining company and arrived via Ford F150. I worked for a major US mining company and flew in via Hughes 500D. That was the pecking order in those days. The property actually belonged to a third company, in this case a major Canadian miner, and we were both trespassing.

This has always been the tried and true way we dumb field geologists in the USA have learned about competitors’ properties. Sneak on Sunday morning and sample their outcrops, trenches, and drill cuttings while they’re still in bed nursing hangovers from their weekly drinking bout on Saturday night.

None of those three mining companies exist today. One was bought out first by Homestake then by Barrick, one was bought out by Newmont, and the third was bought out by Vale. If memory serves, all three were hostile or white knight takeovers.

Such is the nature of capitalism: It’s survival of the fittest; eat or be eaten.

• Secondly, the project: Oremex’ flagship project is Tejamen consisting of 1670 ha and it is positioned in central Durango state, northern Mexico.

The property is located near Nuevo Ideal in the semi-arid high plains province and has favorable terrain, a year round working climate, an all-weather gravel road 15 km from the paved highway, power, and water.

Travel time to Tejamen from the capital city of Durango is about one and a half hours. I can fly from Albuquerque to Durango in a half day.

Good locations and logistics significantly discount the cost of exploration and development and that makes northern Mexico unbeatable as a mining venue. There are no four hour float plane rides, no helicopters, no bugs, no snow, no sunless skies, and no ice roads. Other than perhaps Nevada, there is not a cheaper place to operate in the world.

Tejamen Property, Durango, Mexico

The Tejamen project has a long history of exploration, development, and exploitation at Cerro Prieto and Los Mantos.

There are over a dozen vein zones that were exploited by mine workings from 1885 to 1910 and including a 50 tonne/day mill and cyanide recovery plant. During the 1970’s, Mina Cerro Prieto was developed by an 80 meter shaft, it produced up to 30 tonnes per day, and ore was shipped to a government-supported Fomento Minero concentrator.

From 1978 to 1990, the property was sampled by Consejo Recoursos Minerales, Tormex (Lacana subsidiary), and Luismin. Independence Mining Company drilled 7100 m in 36 holes from 1992-1994 and defined high grade vein structures with lower grade wall rock haloes. At the end of the last exploration cycle in 1998-1999, Kobex International drilled four holes.

Oremex’ Mexican subsidiary acquired the rights to the Tejamen property in 2000 and staked surrounding claims in 2001 and 2002. The company drilled 204 holes from 2003 to 2006 and conducted preliminary metallurgical testing on a composite ore sample.

The geologic setting of Tejamen is typical of the eastern foothills of the Sierra Madre Occidental.

Andesite to dacite volcanic rocks of the Lower Volcanic Series are intruded by dacite porphyry and interlayered with dacite and rhyolite tuffs. Faults on the property trend northeast and north and control the main high-grade sulfide vein zones while manto style mineralization is controlled by low angle structures and volcanic stratigraphy.

At Los Mantos, feeder veins are oxidized to about 50 meters depth and surrounded by low-grade, potentially bulk mineable oxide silver-(gold) haloes. Propylitic alteration is widespread and argillic and silica alteration occur in envelopes up to 80 meters wide around feeder vein structures.

Los Mantos Silver Deposit, Tejamen Project

Tejamen has a 43-101 inferred mineral resource of 22.6 million tonnes, grading 66.9 g/t Ag and 0.05 g/t Au, or 69.8 g/t Ag-equivalent using a cut-off of 20 g/t Ag. The 50.8 million ounces of silver-equivalent resource has been defined on 30 m by 40 m centers by 217 reverse circulation and 24 core holes totaling over 43,000 meters.

As explained above, most so-called silver plays are really base metal mines with by-product silver. Not all silver-equivalent ounces are created equal.

In the case of the Tejamen resource, there are minimal contained base metals that would complicate metallurgical processing or recovery. The contribution of gold to the overall equivalent grade also is very small, less than 5%.

Folks, this is a true silver deposit.

Metallurgical testing on a composite of reverse circulation chips indicated an average silver recovery of 73% for two columns with modest cyanide and lime consumption. Though these results are encouraging they are also very preliminary and additional metallurgical process testing is required.

In late 2006 a scoping study (preliminary economic assessment in 43-101-speak) was completed by Snowden Industry Mining Consultants. Their model envisioned a 10,000 tonne per day open pit, heap leach mine from the two mineralized zones. In its design scenario, Snowden anticipated moving the village of Tejamen to develop and mine the project.

A subsequent internal company analysis used data and cost estimates from the Snowden report and supported initial production from Los Mantos, which contains about 70% of the inferred silver resource and has significant exploration potential. Oremex’ new scenario does not contemplate moving the village.

With the efforts of new management in 2009 Oremex has made considerable progress in establishing amiable relations with the people of Tejamen. This past summer they initiated a community improvement program that hires local people on a rotating basis to clean, repair, and build village infrastructure. They have solicited and received assistance from government at federal, state, and local levels to gain support for the project by the community. In August the company announced they had regained access to the project. Although final agreements are pending, management is optimistic that a surface agreement can be secured in the near future.

• Thirdly, the low market capitalization, which is $10.2 million using the current stock price of 14 cents:

With the 43-101 inferred resource of 50.8 million ounces silver equivalent, the company currently is valued at 20 cents per ounce of silver in the ground. Though I know of no comparable silver-only explorers, this is a very low valuation for any precious metals junior. Using a Au:Ag ratio of 65 and a silver recovery of 70% compared to 85% for high recovery heap leach gold operations, 50.8 million ounces of silver would equate to roughly 644,000 oz of Au.

Let’s use a conservative peer market valuation of $35-45/oz gold in the ground for advanced explorers with inferred resources. This exercise gives a fair market valuation for Oremex of about $23-29 million.

Although Oremex has sufficient working capital at its current level of activity, it must go to the market for financing to significantly advance the Tejamen project. This will result in additional dilution of the company and potentially impact the share price.

Oremex Resources Inc. is clearly an undervalued junior resource company at its current share price of 15c. In my opinion it has a strong chance of doubling in the next 12 months as progress continues on land rights and socio-economic issues at Tejamen and a round of delineation drilling and metallurgical testing advances the project toward development.

I have not yet visited the Tejamen project to conduct due diligence in the field. A field examination will happen in the near future and I will report my findings to you. However, I wanted to inform my loyal readers of this compelling story before the company’s share price starts to rise.

Please note that as a shareholder, I have a vested interest in Oremex. My cost basis is slightly higher than the current price. Oremex is also a sponsor of my website and I am really quite biased. As always folks, I simply choose to inform you of some of my favorites companies in the marketplace thru my Mercenary Musings. I’m assuming that Oremex will resolve its land tenure problems at Tejamen and significantly advance the project in the next 12 months. There is no assurance that these catalysts will happen.

Your risk/reward profile is different than mine and it is likely much less speculative than mine. Please put in some concerted effort, due your own research and your own due diligence on Oremex Resources Inc.

Determine if it is a junior resource company that meets your investing criteria.

Bottom line, this is what I think: Tejamen is indeed a pure silver play in Mexico indeed. Es pura plata.

Que Buena!

And it is undervalued.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. 'Mickey' Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 30 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North

and South America, Europe, and Asia.

Mickey has worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for the past 22 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia.

Mickey is well-known throughout the mining and exploration community due to his ongoing work as an analyst, newsletter writer, and speaker.

Contact: Mickey@MercenaryGeologist.com

Disclaimer: I am a shareholder of Oremex Resources, Inc. and it is a sponsor of my website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and will not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection

and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.

Copyright © 2009 Mercenary Geologist. All Rights Reserved.

YeOldGoldNugget's links of interest

- New Video: As the Dow Goes, So Goes the Country

- New Video: Has the dollar bottomed out?

- New Video: Crude Oil: Lower Levels Ahead?

- New Video: It’s Official Silly Season for Gold

- What do supertraders have in common

- Two Major Forces Collide in the Index Markets

- What’s Gold’s Next Stop?

- Introducing the Perfect Portfolio

- Free Email Trading Course Copy

Get the most recent Trend Analysis on Oremex Resources Inc. by following this link :

Marketclub - Oremex Resources Inc. Trend Analysis

![Live 24 hours silver chart [ Kitco Inc. ]](http://www.kitco.com/images/live/silver.gif)

.png)

No comments:

Post a Comment

Make new friends but keep the old ones, one is silver and the other is gold.

Although gold and silver are not by nature money, money is by nature gold and silver.

With those quotes, YeOldGoldNugget invites you to post a comment.